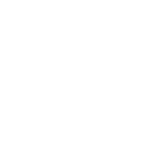

Desktop trading station

Autu's cTrader desktop application has powerful trading and replay functions.

Provides functions such as manual trading, algorithmic trading, copy trading, charting, technical analysis, and market replay, which are used by traders for replay, analysis, backtesting, and optimization.

Customizable interface, allowing users to fold and expand blocks, zoom in/out, change color chart settings, and move charts, all of which can be operated by users themselves.

Web-based trading platform

The web platform can be used on any device without installing any software, allowing you to log in to your account anytime, anywhere.

The web platform can be used on any device without installing any software, allowing you to log in to your account anytime, anywhere.

Mobile trading platform

Android • iPhone

Native applications for trading on iOS and Android devices. These combine rich charting functionalities, advanced order types, and a selection of important account information.

The platform supports 22 languages and allows traders to submit market, limit, stop-loss, and stop-loss limit orders. For each trading instrument, traders can view instrument information, real-time market sentiment, trading schedule, dynamic leverage schedule, external news, etc.

Copy Trading

Any trader can become a strategy provider and broadcast their trading signals to followers. Investors can discover strategies and start and stop copying strategies at any time.

Various advanced risk management functions

Detailed strategy configuration file

Completely transparent, showing full history and open positions

Detailed charts provide rich analysis tools to help traders find the right strategy

User-friendly and intuitive interface

Automated trading

cTrader The cTrader Automate algorithmic trading solution is integrated with the trading platform natively, seamlessly connecting with manual trading and charting functionality, and can also work seamlessly with other platform features.

Traders can use the popular C# language to build automated trading robots and custom indicators, using the powerful cTrader API from the platform, and equipped with the necessary tools to backtest and optimize trading strategies correctly.

Market data, trading history, all order types, and position modification settings, as well as code, account, connection, and error information, are available to incorporate as many details as possible into automated strategies.

cTrader Automate comes with a selection of features that enable users to develop robots and indicators in an efficient and effective manner.

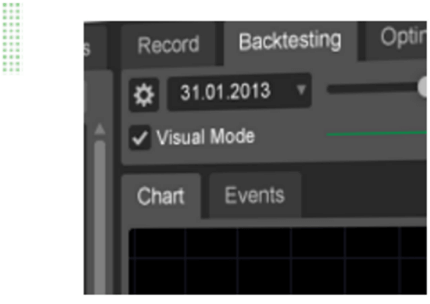

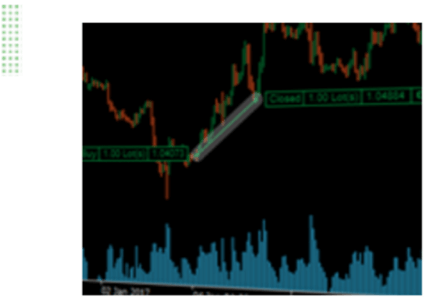

Visual Backtesting

cTrader provides advanced visual backtesting possibilities for testing and visualizing a cBot’s performance against a broker’s own historical tick or trendbar data, over any specified time period.

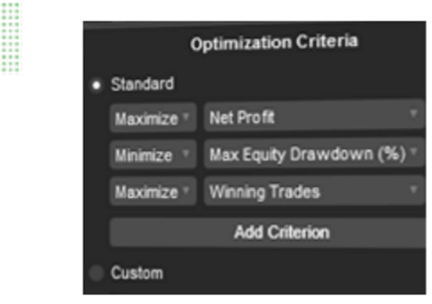

Optimization

An advanced optimization functionality lets traders find the optimal set of parameters for their cBot. Optimization runs multiple backtest procedures, and compares their performance.

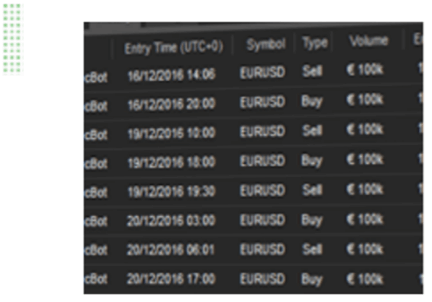

Historical Data

cTrader gives access to historical data of dozens of symbols. Robots can be backtested against accurate historical data for a large number of timeframes, including raw tick data.

A wide range of features is available to support any trader or developer in creating their automated trading strategies and custom indicators.